Personal Income and Outlays - July 2008

Personal Income: Down $89.9 billion (0.7%)

Financial Roadmap: The Week Ahead September 2 to 5, 2008

After relatively strong housing reports and an impressive showing in

the 2nd quarter GDP report last week, Fed watchers will be on alert for

any signs that could point to rate increases – especially in

Wednesday's release of the Federal Reserve Beige Book.

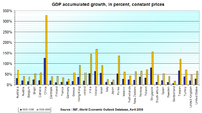

The dollar is poised to make gains against other currencies as US

growth ramps up and other economies, especially Western Europe, slow.

Consumer Spending Slowed in July

Consumer spending rose 0.2% in July, but adjusted for inflation outlays dropped

0.4%, suggesting the economy will weaken with the end of government

stimulus payments.

Consumer Spending in U.S. Slowed in July as Prices Rose Most in 17 Years

U.S. consumer spending grew at a

slower pace in July as the impact of the tax rebates faded and a

pickup in inflation eroded Americans' buying power.

Business Activity Expands at the Fastest Pace in Year, Chicago Index Shows

A measure of U.S. business activity

showed expansion at the fastest pace in more than a year, as

production accelerated the most since October 2004.

European Confidence Drops More Than Forecast; Inflation Rate Falls to 3.8%

Europeans' confidence fell more

than forecast this month as the economy teetered on the brink

of a recession.

Darling Says U.K. Economic Slowdown Is Worst in 60 Years, Guardian Reports

U.K. Chancellor of the Exchequer

Alistair Darling said the British economy is facing the worst

slowdown in 60 years and will not recover as quickly as

originally forecast, the Guardian reported.

Consumer spending flags, but confidence rises

WASHINGTON

(Reuters) - Personal income tumbled unexpectedly in July and

inflation-adjusted spending shrank as government economic stimulus

waned, but consumer spirits rose this month, a hint the economy may

muddle through its woes.

Canada skirts recession in second quarter

OTTAWA, Aug 29 (Reuters) - Canada's economy narrowly

avoided a recession in the second quarter but the tepid 0.3

percent annual growth rate raised doubts about how long the

Bank of Canada could afford to keep interest rates on hold.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=6f088be0-95a9-4ba7-9c2d-8bc98176f093)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=0cc68f0e-d230-4a82-a194-cfa05904c08d)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=29c7ffa6-c650-4c43-a882-ade015967a6d)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=2c3d6fc4-f7f0-4a14-84e2-a7dd309873ed)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=d899ba8e-e3f6-4d10-9a47-98fa5ff4504d)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=6e36ff93-8f67-4c4c-81ab-c38798514796)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=6006dda8-e4ae-4a32-9dc9-dfbec84b2afa)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=402b1ed0-c573-43e3-9276-0f366e2b17e4)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=9b85b1b7-867b-47cb-a6b3-25b58e6caf55)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=bc94d2da-fef9-45e1-ba20-809699fd987b)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=7de905cb-ee28-44b0-8b4a-05586accb4b8)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=18e19518-d899-45d1-992e-6cf602f32049)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=19cc69db-5089-4996-be5c-745e3775e908)